(NEW YORK) — For more than three years, rapid inflation has frustrated shoppers scanning store shelves for deals. But a host of prominent companies are finally delivering relief.

Target, Ikea, Aldi, McDonald’s and Wendy’s are among several well-known brands that have announced lower prices in recent weeks.

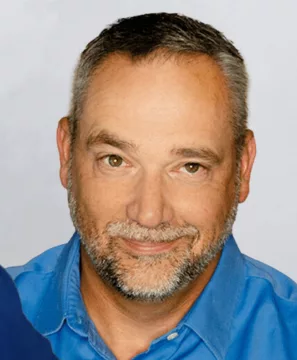

“We know consumers are feeling pressured to make the most of their budget,” Rick Gomez, an executive vice president at Target, said in a statement this week after the company lowered prices for 5,000 items, including frozen pizza and butter.

The rapid-fire series of customer-friendly announcements isn’t a coincidence, economists told ABC News, as many companies fight over customers who are pinching pennies after a prolonged bout of elevated prices.

The competition is most intense between companies, like fast food joints and big-box stores, that cater to low- and middle-income people, experts added.

“After the shell shock of seeing the buying power of their dollar fall so dramatically, consumers are most likely to consider price, price and price as their three most important factors,” Jason Taylor, an economics professor at Central Michigan University, told ABC News.

“It should not be surprising to see firms competing so strongly on price,” Taylor added.

Last week, McDonald’s announced a $5 value meal set to hit stores next month. Wendy’s followed suit on Monday, releasing a $3 deal that features a breakfast sandwich and potatoes.

Aldi, a nationwide grocery chain, said earlier this month that it would lower prices on 250 items, reducing, for instance, the price of sirloin steak from $8.49 to $6.99.

The price cuts come at a time when many customers have few dollars to spare.

In response to accelerated price increases, the Federal Reserve embarked on an aggressive series of interest rate hikes and has yet to ease them. For nearly a year, the Fed has held interest rates at their highest level since 2001.

Price increases, meanwhile, have slowed significantly from a peak of about 9%, but inflation still stands more than a percentage point higher than the Federal Reserve’s target rate of 2%.

The persistence of elevated inflation alongside high interest rates has squeezed many consumers, who grapple with stiff prices but face expensive borrowing costs for loans that could help ease the financial pain.

Over the first three months of 2024, U.S. household debt ballooned to a record $12.44 trillion, climbing $184 billion over that period, or about 1.1%, according to the New York Federal Reserve.

Credit card debt, meanwhile, climbed to a record high $1.13 trillion at the end of last year, New York Federal Reserve data showed.

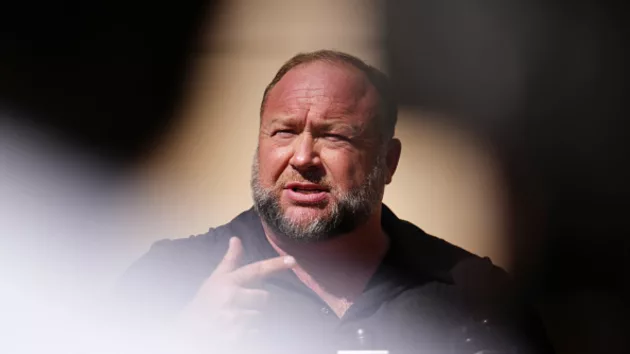

“Debt burdens are much heavier given the aggressive borrowing these households have done to supplement their income and maintain their purchasing power in the face of their higher costs,” Mark Zandi, chief economist at Moody’s Analytics, told ABC news.

In turn, strapped shoppers have become more sensitive in their spending, putting pressure on companies to lower their prices or risk losing out on business, Zandi added.

“Price competition among businesses that generally cater to lower income households is heating up,” Zandi said. “Lower income households are under significant financial pressure.”

Meanwhile, many companies can lower prices without suffering losses, since the outbreak of inflation in the aftermath of the COVID-19 pandemic brought about a surge in profitability, experts said.

In 2021, corporate profit margins skyrocketed from about 11% in the first quarter to 19% in the second, eventually stabilizing at an elevated level of 15% over the ensuing year, Fed data showed.

The profit margins also spur competition, inducing companies to enter a new market or lower prices as a means of capturing some of the lucrative business, Steve Hanke, a professor of applied economics at Johns Hopkins University, told ABC News.

“If profits start getting fat in a free market system, that invites competition and competition whittles the profit margins down,” Hanke said.

He went on, “Target is not insulated. Neither is Aldi, McDonald’s or Wendy’s.”

The discounts may also offer reason to be optimistic about the outlook for inflation, Hanke said, noting that the lower prices suggest an expectation among business leaders that their input costs are unlikely to accelerate.

“They won’t be facing costs that are rising as fast as they are now,” Hanke said. “The hot costs have come out of their expectations.”

Copyright © 2024, ABC Audio. All rights reserved.